missouri gas tax bill 2021

The upper chamber spent about eight hours working on the bill before pulling the proposal. Schatzs Senate Bill 262 would increase Missouris gas tax by 125 cents per gallon by 2025.

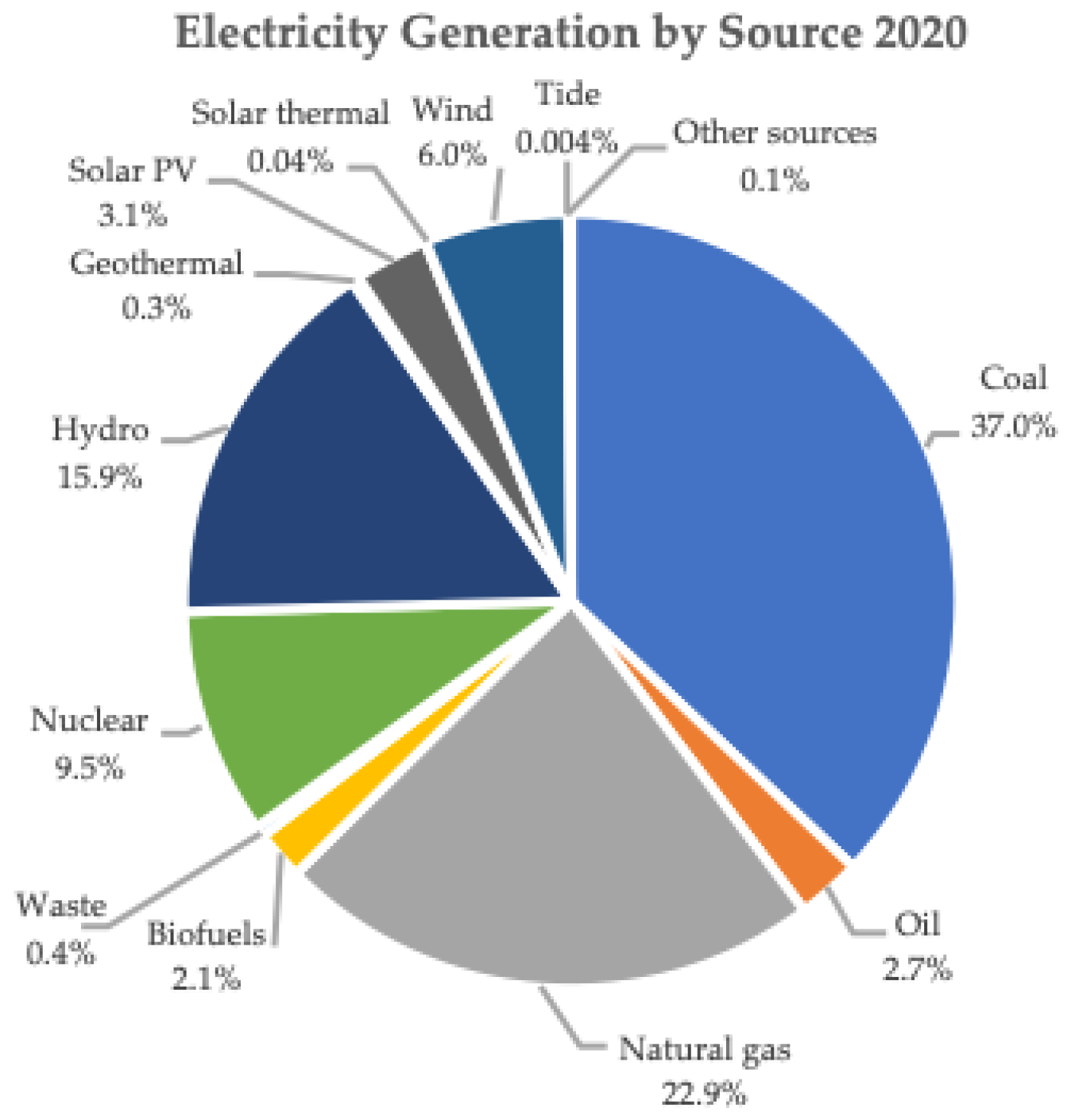

Energies Free Full Text Reviewing Usage Potentials And Limitations Of Renewable Energy Sources Html

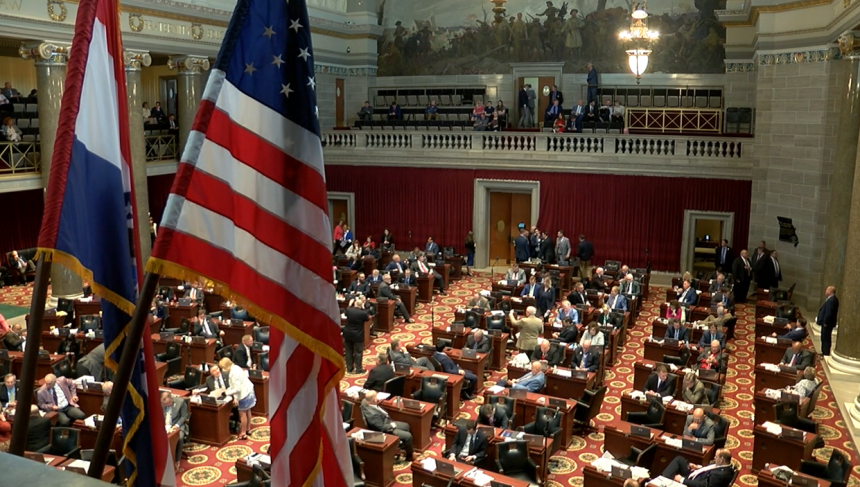

The bill is now on Parsons desk after the GOP-led House voted Tuesday 104-52 in favor of the gas tax increase.

. Missouris fuel tax rate is 17 cents a gallon through September 30 2021 for all motor fuel including gasoline diesel kerosene gasohol ethanol blended with gasoline biodiesel B100. Rudi Keller - November 12 2021 700 am. The tax is set to increase by the same amount yearly between 2021 and 2025.

The measure will gradually raise the states 17-cents-per-gallon gas tax by 125 cents over the next five years. SS2SCSSB 262 - This act modifies provisions relating to transportation. Daniel Mehan president of the Missouri Chamber of Commerce.

Mike Parson has not signed the bill amid concerns about. AP - Missouris Republican-Legislature on Thursday passed several bills to revamp. Current Bill Summary.

Schatzs bill is projected to raise an extra 500 million annually to put toward maintaining Missouris roads. Patrick McKenna director of the Missouri Department of Transportation speaks at the I-70 Bridge groundbreaking ceremony on. An effort to boost Missouris gas tax made its way to the state Senate on Tuesday.

With 65 billion on the way from the federal infrastructure bill and a newly increased gas tax Missouri is ready to take a big bite out of 45 billion in unfunded highway. Legislators passed a bill last week to gradually raise the states 17-cent-a-gallon gas tax to 295 cents over five years with the option for buyers to get a refund if they keep. Starting July 1 Missouri residents can apply online to get a refund for a portion of the states two and a half cent fuel tax as part of Missouris fuel tax rebate program.

Missouri bill would boost gas tax but offer rebates to drivers February 9 2021 By Alisa Nelson A proposed fuel tax increase could come with a rebate option for drivers who fill. A taxpayer purchases 15365 gallons of gasoline on October 25 2021 for off road usage. At the end of 2025 the states tax rate will sit at 295 cents per gallon.

Senate Bill 262 you may be eligible to receive a. The tax will go up 25 cents a year starting this October. 1 2021 Missouris current motor fuel tax rate of 17 cents per gallon will increase to 195 cents per gallon.

R-Maysville speaks on the Missouri House floor on March 4 2021 file. 11 2021 at 306 PM PST. MoDOTs current fuel tax rate generated about 692 million in 2020.

The motor fuel tax rate for this time period is 0195 per gallon. Missouri lawmakers agreed to raise the states gas tax for the first time in 25 years during their 2021 session but Gov. MOTOR FUEL TAX Sections 142803 142822 and 142824 This act enacts.

The tax increase could. By The Associated Press.

How To Switch To Shipping Ddp And Why Ecommerce Sellers Should

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

2022 Legislation A Look At What Will Drive The Missouri Legislature Next Year

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

States With The Highest And Lowest Gasoline Tax

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Energy Storage News Fractal Energy Storage Consultants

Indirect Tax Kpmg United States

States With The Highest And Lowest Gasoline Tax

States With The Highest And Lowest Gasoline Tax

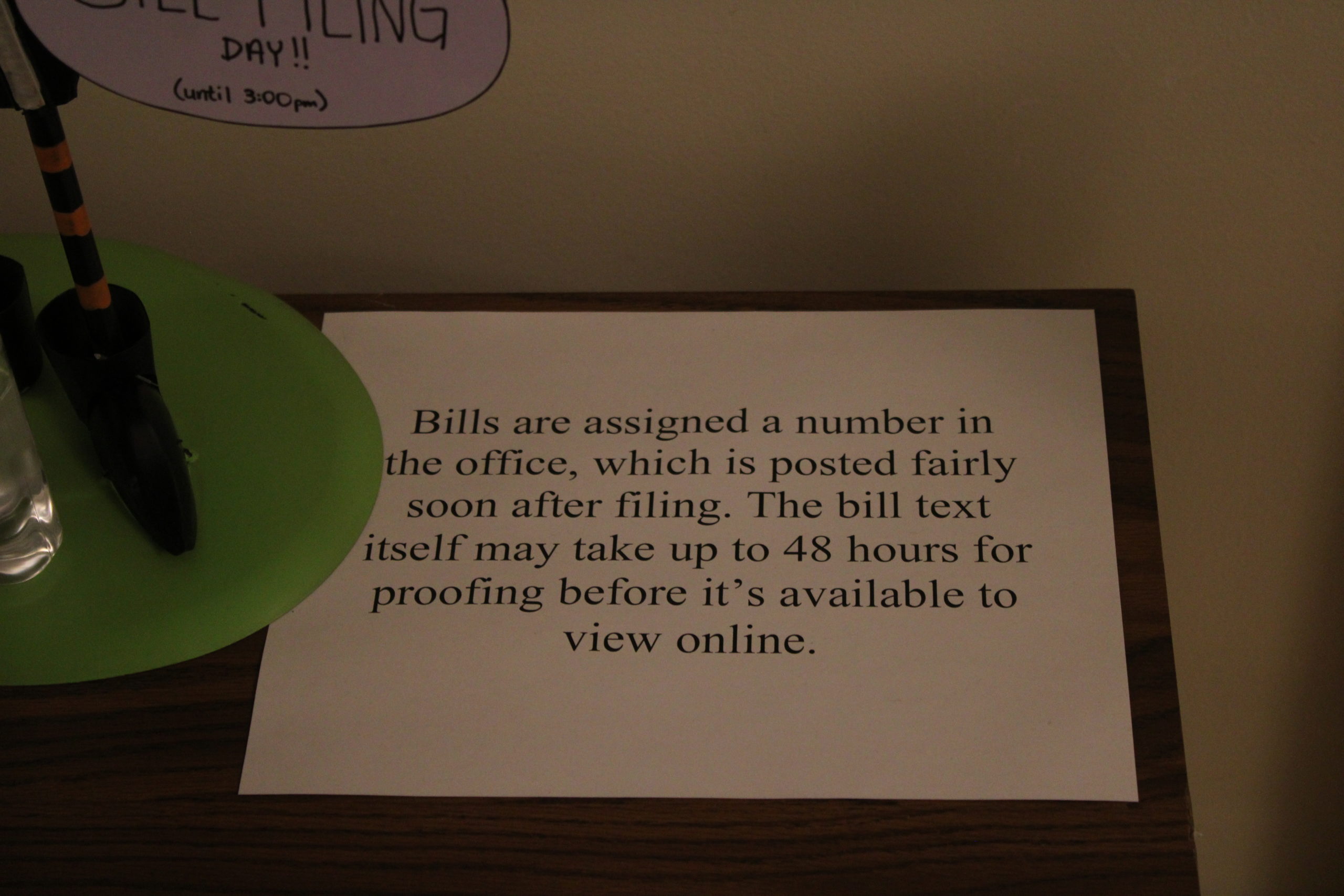

Last Day Of 2021 Session Gas Tax Online Taxes Forms Of Birth Control

Missouri S Governor Expects To Sign Gas Tax Legislation After Bill S Language Is Reviewed Audio Missourinet

Ransomware Attack List And Alerts Cloudian

States With The Highest And Lowest Gasoline Tax

2022 Legislation A Look At What Will Drive The Missouri Legislature Next Year

Unsecured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Indirect Tax Kpmg United States

State Rep Says Proposed Parole Changes Not Meant For Cole County Killer Abc17news